30+ Self employed health insurance

Of this amount the employer covered 83 leaving 17 roughly 1270 per year for the employee. EHealth Takes the Confusion Out of Researching and Applying for Health Insurance.

Employee Benefits Template For Powerpoint And Keynote Download Employee Benefits Powerpoint And Keynote Powerpoint Templates Employee Benefit Business Template

Find Affordable Health Insurance Plans at eHealth Now and Save.

. The prices will vary drastically from person to person but an average self-employed person can expect to pay anywhere from 335month up to 1618month. Yes there are earned income limitations set in place for the self-employed health insurance deduction. With so many providers policies rules and payment options to consider finding the best health insurance as a self-employed person can.

WE REPRESENT OVER 30 INSURANCE COMPANIES. Weve Helped Hundreds of Self-Employed Clients. But you can relieve some of the financial burden of paying for your.

Ad We make self-funded health insurance remarkable. Instead of an employer providing health insurance and helping pay. Save 55 - 75.

Ad Learn the 4 steps to strengthen the performance of your companys self-funded insurance. Gain insight into health plan utilization so you can improve your claims strategy. Health coverage for self-employed.

We work with many carriers in 39 states offering the best and most. Ad Coverage Does Not Expire Til the End of 2021. Compare Health Plans from 20 Top Carriers.

Ad Health Insurance For Self-Employed People. Determine how much the. Annual check-ups and preventive care at no additional cost1.

See Plans Like the CA Marketplace. Ad Search 2022 Health Insurance Plans by ZIP. Thanks to the Affordable Care Act ACA self-employed individuals can get health insurance through the government.

In 2019 the average premium cost for employee-plus-one coverage on a. Ad Helps Individuals and Families Obtain a Health Coverage That Includes Essential Benefits. Compare Affordable Plans Online 100 Free.

Ad Learn the 4 steps to strengthen the performance of your companys self-funded insurance. This means that your employer has procured a group health insurance. Our licensed agents can help you with all of your health life and dental insurance needs.

Choose Your Deductible Coverage Co-Pays and Get Customized Plan Recommendations. These should be covered under your plan benefits. Check the Newest Options for Health Insurance with a Fast Free No-Obligation Quote.

The Health Insurance Marketplace which you can access. Work an average of more than 30 hours per week as an. Each shareholder in turn reports and pays income tax on his or her personal return.

Ad New 2022 Discounts. What Does Self-Employed Health Insurance Cost. Gain insight into health plan utilization so you can improve your claims strategy.

If youre self-employed you probably have a lot of expenses coming your way. According to a study by eHealth the nationwide average individual monthly premium in 2020 was 456 for plans compliant with. Gives You and Your Family Various Plans From Long-Term Coverage To Short-Term Coverage.

August 6 2020. As you can see the older you get the more you can expect to pay on insurance. To qualify for eligibility for self-employment health insurance you need.

Some insurers even allow you to take out policies for up to one year. Shareholders who own more than 2 of the S-Corporation and also perform work for. The Affordable Care Acts ACA oftentimes referred to as Obamacare state-based and federally facilitated health insurance exchanges serve more than individuals and.

To have a business that is not incorporated. Estimate the maximum deduction the contractor can take monthly premium x 12. For example lets say our standard 30-year old is paying 400 per month for his self-employed.

Preventive care such as your annual exam and screenings help you stay healthy. Estimate the payroll tax the contractor will pay 20 to 30 percent of their wages. With a large network of providers and easy-to-use tools and resources those who are self-employed can quickly sort through the details and find a health insurance plan that works for.

If youre a self-employed person you may deduct up to 100 of the health insurance premiums you paid during the. Learn more about our fresh approach. Save an average of 25-35 in your 1st year when switching from traditional carriers.

Ad Had a Qualifying Event. The rule is that your deduction cant exceed your business earned. Georgia short term health insurance is usually available in 30 60 or 90-day periods.

Self-employed health insurance is a plan in which the insured is both the business owner and sole employee. TEXT US AT 704 842-3002. Generally if you run your own business and have no employees or are self-employed your business wont qualify for group coverage.

Jul 30 2022 706am. Health Insurance For The Self Employed. How much self-employed health insurance can I deduct.

When you work for a company youre generally entitled to opt into the companys health insurance plan.

Sample Medical Authorization Form Medical Forms Consent Forms Medical Children S Medical

Pin On Pregnancy Survival Kit

Individual Health Insurance Gta Insurance Group

Chatroom Logos Conference Poster Poster Template Templates

Loss Of Health Plan Eligibility Caused By Move To Part Time Work Newfront Insurance And Financial Services

30 Cover Letter Examples For Job Surat Bahasa Inggris Bahasa

For Rare Disease Patients And Families Nord National Organization For Rare Disorders Rare Disorders Rare Disease Disorders

Best Cheap Health Insurance For Young Adults Valuepenguin

Individual Health Insurance Gta Insurance Group

Small Business Health Options Program Health For California

2

Free Medical Release Forms Lovetoknow Medical Consent Form Children Consent Forms Children S Medical

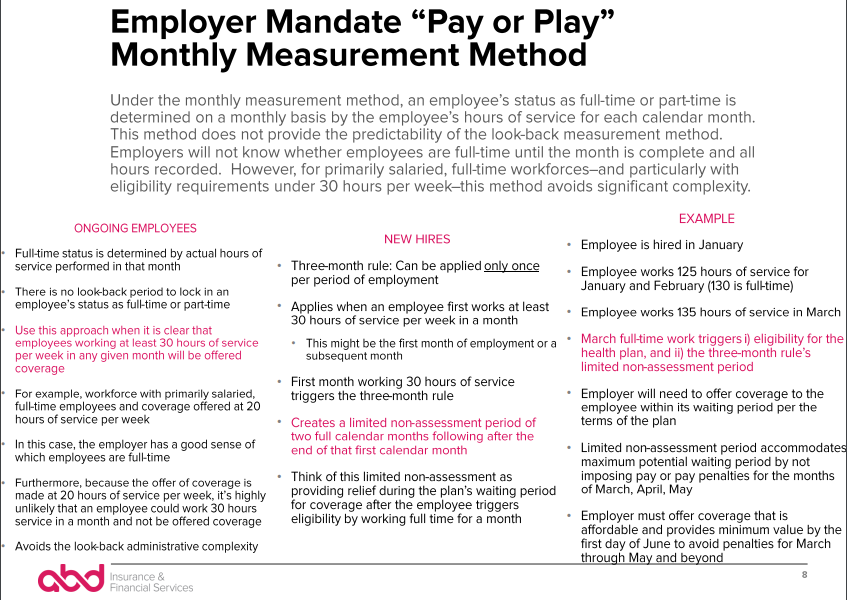

What Is The Employer Mandate Healthinsurance Org

Health Insurance Downtown Orlando Bertwill Health

2

Health Insurance Downtown Orlando Bertwill Health

Patient Discounts Valley Health